Green Light

Proceed through a Green Light without hesitation, would get any card identified with a green light without giving it a second thought. All these are elite Credit Cards

Yellow Light

Proceed through a Yellow Light with hesitation but still run a yellow 9/10 times, would get any card identified with a yellow light but think twice or take a step back before applying

Red Light

Proceed through a Red Light with a good reason (wife’s about to give birth) would only get a card identified with a red light for a GOOD reason (going on a cruise or need to build your credit)

AMERICAN EXPRESS PLATINUM

Green Light

-Good return on intro spend

-Great card to have for 1 year

-Intro bonus makes the annual fee worth it

Pros:

-Earn 75,000 membership rewards points after spending $5,000 in purchases on your card within 3 months of opening

-Earn 5 points for every $1 spent directly with airlines or on travel purchases booked through amextravel.com

-$200 in statement credits for one airline of your choice on incidental fees like checked bags and in-flight refreshments when you pay with your Platinum Card

-$100 in annual statement credits at Saks Fifth Avenue or saks.com ($50 from Jan to June and another $50 from July to Dec)

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Hotel Collection – book at least 2 consecutive nights at participating properties and receive a $100 hotel credit to spend on dining, spa, or other resort activities and a complimentary room upgrade when available

-$200 a year in Uber Cash (distributed out in $15 increments per month, with a bonus $20 in December)

-Global Lounge Collection (Centurion, International American Express, Delta Sky Clubs, and Priority Pass Lounges)

-No foreign transaction fees

-Marriott Bonvoy and Hilton Honors Gold Status

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

-Car Rental Loss and Damage Insurance, Baggage Insurance Plan, Trip Cancellation and Interruption Insurance, Trip Delay Insurance

Cons:

-$550 annual fee not waived for the first year

-Earn 1 membership rewards point for every $1 spent on all other purchases

-Membership rewards points disappear if you close the account

-Must keep the account open for 12 months or Amex can take back your intro membership rewards points

-Priority Pass membership does not include the restaurant locations like other high end cards that include the Priority Pass

AMERICAN EXPRESS GREEN CARD

Green Light

-Good return on intro spend

-Green Card OVER Amex Gold Card

-Intro bonus makes the annual fee worth it

Pros:

-Earn 45,000 membership points after spending $2,000 in purchases on your card within 3 months of opening

-Earn 3 points for every $1 spent on flights, hotels, transit, taxis, ridesharing, and restaurants worldwide

-$100 in statement credits per calendar year when you pay for your CLEAR membership on your card

-$100 in statement credits per calendar year when you purchase lounge access through LoungeBuddy

-No foreign transaction fees

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

-Trip Delay Insurance, Car Rental Loss and Damage Insurance, Baggage Insurance Plan, Purchase Protection, and Extended Warranty

Cons:

-$150 annual fee not waived for the first year

-Earn 1 membership rewards point for every $1 spent on all other purchases

-Membership rewards points disappear if you close the account

-Must keep the account open for 12 months or Amex can take back your intro membership rewards points

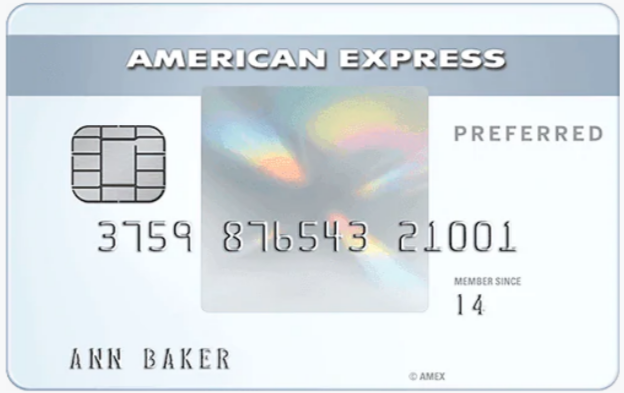

BLUE CASH PREFERRED CARD

Green Light

-Great return (30%) on intro spend

-Spend $132 a month at grocery stores and the annual fee pays for itself

Pros:

-Earn $300 cash back after spending $1,000 in purchases on your card within 3 months

-Earn 6% cash back on up to $6,000 in purchase per year at grocery stores

-Earn 6% cash back on select U.S. streaming subscriptions

-Earn 3% cash back on transit (taxis/rideshare, parking, tolls, trains, buses, and more)

-Earn 3% cash back at U.S. gas stations

-Car Rental Loss and Damage Insurance and Return Protection

Cons:

-$95 annual fee not waived for the first year

-Earn 1% cash back for every $1 spent on all other purchases

-Cash back disappears if you close the account

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fees

DELTA SKYMILES GOLD CARD

Green Light

-Good return on intro spend

-Seasonally boost offer to 70k miles

-Annual fee is waived for the first year of membership

Pros:

-Earn 50,000 bonus miles after you spend $1,000 in purchases on your card within 3 months of opening

-Get a $100 Delta flight credit if you spend $10,000 on your card annually

-First checked bag is complimentary on Delta flights

-No foreign transaction fees

-No annual fee for the first year of membership

-Car Rental Loss and Damage Insurance, Purchase Protection, and Extended Warranty

-Keep your intro miles if you cancel the card

Cons:

-$99 annual fee after the first year of membership

-Earn 2 miles for every $1 spent on Delta purchases

-Earn 2 miles for every $1 spent at restaurants and US supermarkets

-Earn 1 mile for every $1 spent on everything else

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

DELTA SKYMILES PLATINUM CARD

Green Light

-Good return on intro spend

-Annual fee paid for after 10 checked bags on Delta

-Keep the miles if you cancel the card

Pros:

-Earn 70,000 bonus miles after you spend $2,000 in purchase on your card within 3 months of opening

-Earn 3 miles for every $1 spent on hotels and Delta purchases

-Receive a Domestic Main Cabin round-trip companion certificate each year upon renewal of your Card

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Exclusive $39 per person per visit for you and up to two guests at the Delta Sky Club when traveling on a Delta flight

-No foreign transaction fees

-Car Rental Loss and Damage Insurance, Trip Delay Insurance, Baggage Insurance Plan, Purchase Protection, Extended Warranty

-Keep your intro miles if you cancel the card

Cons:

-Annual fee of $250 not waived for the first year of membership

-Earn 2 miles for every $1 spent at restaurants and US supermarkets

-Earn 1 mile for every $1 spent on everything else

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

MARRIOT BONVOY BRILLIANT CARD

Green Light

-Good return on intro spend

-$300 credit towards Marriott purchases

-Love free anniversary nights

Pros:

-Earn 75,000 bonus Bonvoy points after spending $3,000 in purchase on your card within 3 months of opening

-Earn 6 points for every $1 spent with your card on Marriott purchases

-Earn 3 points for every $1 spent on flights booked directly with airlines and US restaurants

-Earn 2 points for every $1 spent on everything else

-$300 statement credits each year of Card Membership for purchases made with Marriott Bonvoy hotels

-1 Free Night Award each year after your first anniversary that can be used for a redemption level up to 50,000 Marriott Bonvoy points

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Book a minimum 2 night stay direct with your card at Ritz-Carlton or St. Regis properties and get a $100 hotel credit

-Complimentary Gold Elite Status

-Priority Pass Select membership included

-No foreign transaction fees

-Car Rental Loss and Damage Insurance, Baggage Insurance Plan, Wasn’t a Perfect Match? Protection

-Keep your intro miles if you cancel the card

Cons:

-Annual fee of $450 not waived for the first year of membership

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Bonvoy points can be weak if not redeemed in the correct fashion

-Bonvoy points are exclusive to Marriott products

BLUE BUSINESS CASH CARD

Green Light

-OK return on intro spend

-No annual fee

-0% intro APR for 12 months

Pros:

-Earn a $250 statement credit after you spend $5,000 in purchases on your card within 6 months of opening the account and earn an extra $250 statement credit after you spend an additional $10,000 in purchases on your cars within the first year

-Earn 2% cash back on all purchases up to $50,000

-0% intro APR on new purchases and balance transfers for 12 months

-No annual fee

-Car Rental Loss and Damage Insurance, Purchase Protection and Extended Warranty

Cons:

-Earn 1% cash back for every $1 spent on all other purchases

-Cash back disappears if you close the account

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fees

AMAZON PRIME BUSINESS CARD

Green Light

-Good return on intro spend

-Great card if your business uses Amazon a lot

-Get a prime membership and unlock massive savings with no annual fee

Pros:

-Eligible Prime Members get a $125 amazon.com gift card upon approval and earn an additional $100 statement credit after you spend $3,000 in purchases excluding those at Amazon Business, AWS, Amazon.com, and Whole Foods

-Earn 5% cash back or 90 days to pay interest free on US purchases at Amazon Business, AWS, Amazon.com, and Whole Foods

-Earn 2% back at US restaurants, US gas stations, and wireless phone service from US providers

-No annual fee

-No foreign transaction fees

-Car Rental Loss and Damage Insurance and Baggage Insurance Plan

Cons:

-Earn 1% cash back on everything else

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Benefits pretty exclusive to Amazon usage

-High APR and no late payment benefits on purchases outside of amazon brands (if that is important to your business)

AMERICAN EXPRESS GOLD CARD

Yellow Light

-OK return on intro spend

-$250 annual fee

-Cool card to have in your wallet

Pros:

-Earn 50,000 membership rewards points after spending $4,000 in purchases on your card within 3 months of opening

-Earn 4 points for every $1 spent at restaurants worldwide and US supermarkets

-Earn 3 points for every $1 spent on flights booked directly with airlines or at amextravel.com

-$10 statement credit per month when you use your Gold Card at Grubhub, Seamless, The Cheesecake Factory, Ruth Chris Steakhouse, Boxed, and participating Shake Shack locations

-$100 in statement credits for one airline of your choice on incidental fees like checked bags and in-flight refreshments when you pay with your Gold Card

-Hotel Collection – book at least 2 consecutive nights at participating properties and receive a $100 hotel credit to spend on dining, spa, or other resort activities and a complimentary room upgrade when available

-No Foreign Transaction Fees

-Baggage Insurance Plan and Car Rental Loss and Damage Insurance

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

Cons:

-$250 annual fee not waived for the first year of membership

-Earn 1 point for every $1 spent on all other purchases

-No anniversary bonus in exchange for your annual fee

-If you cancel your card you loose your unused membership points

-Must keep the account open for 12 months or Amex can take back your intro bonus

-The Green Card has a similar sized intro bonus for less spend and lower annual fee

CASH MAGNET CARD

Yellow Light

-Good return on intro spend

-No annual fee

-0% intro APR for 15 months

Pros:

-Earn $200 in cash back after spending $1,000 in purchases on your card within 3 months of opening

-Earn 1.5% cash back for every $1 spent on your card

-No annual fee

-Car Rental Loss and Damage Insurance

-0% intro APR on new purchase and balance transfers for 15 months

Cons:

-Better return on intro spend with the Chase Freedom cards

-If you cancel your card you loose your unused cash back

-2.7% Foreign Transaction Fee

-3% balance transfer fee

BLUE CASH BACK EVERYDAY

Yellow Light

-Good return on intro spend

-No annual fee

-0% intro APR for 15 months

Pros:

-Earn $200 in cash back after spending $1,000 in purchases on your card within 3 months of opening

-Earn 3% cash back on purchases at supermarkets up $6,000 per year

-Earn 2% cash back at U.S. gas stations and select U.S. department stores

-No annual fee

-Car Rental Loss and Damage Insurance

-0% intro APR on new purchase and balance transfers for 15 months

Cons:

-Earn 1% cash back on all other purchases

-Better return on intro spend with the Chase Freedom cards

-If you cancel your card you loose your unused cash back

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fee

-3% balance transfer fee

AMERICAN EXPRESS EVERYDAY CREDIT CARD

Yellow Light

-Low return on intro spend

-No annual fee

-0% intro APR for 15 months

-AMEX cash back options are better

Pros:

-Earn 10,000 membership rewards points after spending $1,000 in purchase on your card within 3 months

-0% intro APR on new purchase and balance transfers for 15 months

-$0 Balance transfer fee on transfers requested within 60 days of account opening (saves you $30 for every $1000 in balance transfers)

-If you use your card 20 times on purchases in a billing period earn 20% more points on those purchases

-No annual fee

-Car Rental Loss and Damage Insurance

Cons:

-Earn 2 points for every $1 spent at grocery stored up to $6,000 per year in purchases

-Earn 1 membership point for every $1 spent on all other purchases

-Better return on intro spend with the Cash Magnet and Blue Cash Back Everyday cards

-If you cancel your card you loose your unused cash back

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fee

-Can’t make balance transfers after the 60 day intro period

DELTA SKYMILES RESERVE CARD

Yellow Light

-Good card for a Delta Loyalist

-Amex Platinum gets you similar, arguably better benefits

-Juicy companion certificate

Pros:

-Earn 70,000 bonus miles and 10,000 MQMs after spending $5,000 in purchases on your card within 3 months of opening

-Earn 3 miles for every $1 spent on Delta purchases

-Earn 15,000 MQMs after spending $30,000 in purchases on your card, up to 4 times a year, and get the MQD (Medallion Qualification Dollar) waiver after spending $25,000 in purchases on your card

-First checked bag is complimentary on Delta flights

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Complimentary access to Delta Sky Lounges when your flying delta and 2 complimentary guest pass each year

-Complimentary access to Centurion Lounges when you book your Delta flight with your Reserve Card

-No Foreign Transaction Fees

-Car Rental Loss and Damage Insurance, Trip Delay Insurance, Trip Cancellation, Baggage Insurance Plan, Purchase Protection, Extended Warranty

-Keep the miles if you cancel your card

Cons:

-Annual fee of $550 not waived for the first year

-Earn 1 mile for every $1 spent on all other purchases

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

HILTON HONORS CARD

Yellow Light

-OK return on intro spend

-No annual fee

-Hilton points carry very weak value

Pros:

-Earn 100,000 Hilton Honors bonus points after spending $1,000 in purchases on your card within 3 months of opening

-Earn 7 points for every $1 spent on Hilton purchases

-Earn 5 points for every $1 spent at US gas stations, US restaurants, and US supermarkets

-Earn 3 points for every $1 spent on everything else

-Complimentary Hilton Honors Silver status and get Gold status after making $20,000 in purchases on your card in a calendar year

-Book 4 nights with points and get the fifth night free

-No annual fee

-No Foreign Transaction Fees

-Car Rental Loss and Damage Insurance

-Keep the bonus points if you cancel your card

Cons:

-7x on Hilton spend 1/3 of the 25x on IHG spend

-Hard to find Hilton redemptions for less than 30,000 points a night

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Points exclusive to Hilton products

HILTON HONORS SURPASS CARD

Yellow Light

-OK return on intro spend

-$95 annual fee

-Priority Pass Lounge visits are worth the annual fee

Pros:

-Earn 150,000 Hilton Honors bonus points after spending $3,000 in purchases on your card within 3 months of opening

-Earn 12 points for every $1 spent on Hilton purchases charged to your card

-Earn 6 points for every $1 spent at US gas stations, US restaurants, and US supermarkets

-Earn 3 points for every $1 spent on everything else

-Complimentary Gold status plus spend $40,000 on purchases on your card in a calendar year and receive Hilton Diamond Status

-Book 4 nights with points and get the fifth night free

-10 Free Priority Pass Lounge visits per year

-No Foreign Transaction Fees

-Car Rental Loss and Damage Insurance

-Keep the bonus points if you cancel your card

Cons:

-$95 annual fee is not waived the first year of membership

-12x on Hilton spend 1/2 of the 25x on IHG spend

-Hard to find Hilton redemptions for less than 30,000 points a night

-Must keep the account open for 12 months or Amex can take back your intro bonus

-No free anniversary night for the annual fee

-Points exclusive to Hilton products

HILTON HONORS ASPIRE CARD

Yellow Light

-Low return on intro spend

-$450 annual fee

-Great benefits if you like to stay at Hilton properties

Pros:

-Earn 150,000 Hilton Honors bonus points after spending $4,000 in purchases on your card within 3 months of opening

-Earn 14 points for every $1 spent on Hilton purchases charged to your card

-Earn 7 points for every $1 spent at US gas stations, US restaurants, and US supermarkets

-Earn 3 points for every $1 spent on everything else

-Complimentary Hilton Diamond Status

-One complimentary weekend night reward plus earn an additional night after you spend $60,000 on purchases with your card in a calendar year

-$250 Hilton Resort statement credit (can be used on rooms as long as it’s not an Advanced Purchase Rate or Non-Refundable Rate)

-$250 Airline fee credit (pick one airline per year and get $250 in statement credits on incidentals such as checked baggage, in-flight refreshments, and flight change fees)

-Book a 2 night stay at Hiltonhonors.com/aspirecard and get up to $100 in resort credits at participating Waldorf Astoria and Conrad properties

-Book 4 nights with points and get the fifth night free

-Priority Pass Select membership

-No Foreign Transaction Fees

-Car Rental Loss and Damage Insurance, Baggage Insurance Plan, Wasn’t a perfect match purchase protection

-Keep the bonus points if you cancel your card

Cons:

-$450 annual fee is not waived the first year of membership

-14x on Hilton spend 1/2 of the 25x on IHG spend

-Hard to find Hilton redemptions for less than 30,000 points a night

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Harder than it sounds to take full advantage of the $250 Airline fee credit

-Points exclusive to Hilton products

AMERICAN EXPRESS PLATINUM BUSINESS

Yellow Light

-Low return on intro spend

-Clout for your business

-Better bang for your buck with the personal Platinum Card

Pros:

-Earn 75,000 membership rewards points after spending $15,000 in purchases on your card within 3 months of opening

-Earn 5 points for every $1 spent directly with airlines or on travel purchases booked through amextravel.com

-Earn 1.5x points on all purchases for $5,000 or more. Up to 1 million additional points per year

-$200 in statement credits for one airline of your choice on incidental fees like checked bags and in-flight refreshments when you pay with your Platinum Card

-$200 in annual statement credits on spend with Dell ($100 from Jan to June and another $100 from July to Dec)

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Hotel Collection – book at least 2 consecutive nights at participating properties and receive a $100 hotel credit to spend on dining, spa, or other resort activities and a complimentary room upgrade when available

-Global Lounge Collection (Centurion, International American Express, Delta Sky Clubs, and Priority Pass Lounges)

-No foreign transaction fees

-Marriott Bonvoy and Hilton Honors Gold Status

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

-Car Rental Loss and Damage Insurance, Baggage Insurance Plan, Trip Cancellation and Interruption Insurance, Trip Delay Insurance

Cons:

-$595 annual fee not waived for the first year

-Earn 1 membership rewards point for every $1 spent on all other purchases

-Membership rewards points disappear if you close the account

-Must keep the account open for 12 months or Amex can take back your intro membership rewards points

-Priority Pass membership does not include the restaurant locations like other high end cards that include the Priority Pass

AMERICAN EXPRESS GOLD BUSINESS CARD

Yellow Light

-OK return on intro spend

-Clout for your business

-Better bang for your buck out of the personal Gold Card

Pros:

-Earn 50,000 membership rewards points after spending $5,000 in purchases on your card within 3 months of opening

-Earn 4 points for every $1 spent to the first $150,000 on the 2 categories where your business spends each business cycle

-$100 in statement credits for one airline of your choice on incidental fees like checked bags and in-flight refreshments when you pay with your Gold Card

-Hotel Collection – book at least 2 consecutive nights at participating properties and receive a $100 hotel credit to spend on dining, spa, or other resort activities and a complimentary room upgrade when available

-No Foreign Transaction Fees

-Baggage Insurance Plan and Car Rental Loss and Damage Insurance

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

-Flexible solutions for managing cash flow

Cons:

-$295 annual fee not waived for the first year of membership

-Earn 1 point for every $1 spent on all other purchases

-No anniversary bonus in exchange for your annual fee

-If you cancel your card you loose your unused membership points

-Must keep the account open for 12 months or Amex can take back your intro bonus

AMERICAN EXPRESS GREEN BUSINESS CARD

Yellow Light

-OK return on intro spend

-Annual fee is waived for the first year

-Better bang for your buck out of the personal Green Card

Pros:

-Earn 25,000 membership points after spending $3,000 in purchases on your card within 3 months of opening

-Annual fee is waived for the first year of membership

-Baggage Insurance Plan and Car Rental Loss and Damage Insurance

-Good point transfer partner options (Delta, JetBlue, Marriott, etc)

Cons:

-$95 annual fee after the first year of membership

-Earn 2 points for every $1 spent on purchases with amextravel.com

-Earn 1 point for every $1 spent on all other purchases

-No anniversary bonus in exchange for your annual fee

-If you cancel your card you loose your unused membership points

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fee

MARRIOTT BONVOY BUSINESS CARD

Yellow Light

-Good return on intro spend

-Annual fee is covered by the free anniversary night

-Low intro spend compared to other Amex Business Cards

Pros:

-Earn 75,000 bonus Marriott Bonvoy points after making $3,000 in purchase on your card within 3 months of opening

-Earn 6 points for every $1 spent at Marriott Bonvoy hotels

-Earn 4 points for every $1 spent at US restaurants, US gas stations, US wireless phone providers, and US shipping

-Earn 2 points for every $1 spent on everything else

-Receive 1 Free Night Award each year after your first anniversary that can be used for a redemption level up to 35,000 Marriott Bonvoy points plus earn an extra free night after making $60,000 in purchases on your card in a calendar year

-No Foreign Transaction Fees

-Baggage Insurance Plan and Car Rental Loss and Damage Insurance

-Keep your intro bonus points if you cancel the card

Cons:

-$125 annual fee is not waived for the first year of membership

-6 points for every $1 spent on Marriott properties is pretty weak compared to 25x on IHG spend

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Bonvoy points can be weak if not redeemed in the correct fashion

-Bonvoy points are exclusive to Marriott products

DELTA SKYMILES GOLD BUSINESS CARD

Yellow Light

-Good return on intro spend

-Annual fee is waived for the first year of membership

-Annual fee pays for itself after 4 checked bags on Delta

Pros:

-Earn 40,000 bonus miles after you spend $2,000 in purchases on your card within 3 months of opening

-Get a $100 Delta flight credit if you spend $10,000 on your card annually

-First checked bag is complimentary on Delta flights

-No foreign transaction fees

-No annual fee for the first year of membership

-Car Rental Loss and Damage Insurance, Purchase Protection, and Extended Warranty

-Keep your intro miles if you cancel the card

Cons:

-$99 annual fee after the first year of membership

-Earn 2 miles for every $1 spent on Delta purchases

-Earn 2 miles for every $1 spent at restaurants and US supermarkets

-Earn 1 mile for every $1 spent on everything else

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

-High APR and no late payment benefits on purchases outside of amazon brands (if that is important to your business)

DELTA SKYMILES PLATINUM BUSINESS CARD

Yellow Light

-OK return on intro spend

-Annual fee pays for itself after 10 checked bags on Delta

-Juicy companion certificate

Pros:

-Earn 45,000 bonus miles and 5,000 MQMs after you spend $3,000 in purchase on your card within 3 months of opening

-Earn 3 miles for every $1 spent on hotels and Delta purchases

-Earn 1.5x miles on all purchases for $5,000 or more. Up to 50,000 additional miles per year

-Receive a Domestic Main Cabin round-trip companion certificate each year upon renewal of your Card

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Exclusive $39 per person per visit for you and up to two guests at the Delta Sky Club when traveling on a Delta flight

-No foreign transaction fees

-Car Rental Loss and Damage Insurance, Trip Delay Insurance, Baggage Insurance Plan, Purchase Protection, Extended Warranty

-Keep your intro miles if you cancel the card

Cons:

-Annual fee of $250 not waived for the first year of membership

-Earn 2 miles for every $1 spent at restaurants and US supermarkets

-Earn 1 mile for every $1 spent on everything else

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

-High APR and no late payment benefits (if that is important to your business)

BLUE BUSINESS PLUS CARD

Yellow Light

-Low return on intro spend

-No annual fee

-0% intro APR for 12 months

Pros:

-Earn 10,000 membership rewards points after spending $3,000 in purchases on your card within 3 months of opening

-Earn 2 points for every $1 spent on everyday business purchases up to $50,000

-No annual fee

-0% intro APR on new purchase and balance transfers for 12 months

-Car Rental Loss and Damage Insurance

-Keep your intro bonus points if you cancel the card

Cons:

-Earn 1 point for every $1 spent on everything else

-If you cancel your card you loose your unused membership points

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fee

HILTON HONORS BUSINESS CARD

Yellow Light

-OK return on intro spend

-$95 annual fee covered by priority pass visits

-Opportunities to earn free nights

Pros:

-Earn 125,000 Hilton Honors bonus points after spending $3,000 in purchases on your card within 3 months of opening

-Earn 12 points for every $1 spent on Hilton purchases

-Earn 6 points for every $1 spent at US gas stations, wireless phone service with US providers, US shipping, US restaurants, flight booked directly with airlines or with Amex Travel, and car rentals booked directly with rental companies

-Earn 3 points for every $1 spent on everything else

-Complimentary Gold status plus spend $40,000 on purchases on your card in a calendar year and receive Hilton Diamond Status

-Earn a free weekend night when you spend $15,000 on your card in a calendar year and extra after you spend $60,000 on your card in a calendar year

-No Foreign Transaction Fees

-10 Free Priority Pass Lounge visits per year

-Car Rental Loss and Damage Insurance

-Keep your intro bonus points if you cancel the card

Cons:

-$95 annual fee is not waived the first year of membership

-12x on Hilton spend 1/2 of the 25x on IHG spend

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Points exclusive to Hilton products

-High APR and no late payment benefits (if that is important to your business)

AMAZON BUSINESS CARD

Yellow Light

-Low return on intro spend

-No annual fee

-Huge savings on Amazon purchases with no annual fee

Pros:

-Earn a $100 Amazon.com gift card upon approval and an additional $100 statement credit after you spend $3,000 in purchases excluding those at Amazon Business, AWS, Amazon.com, and Whole Foods

-Earn 3% cash back or 60 days to pay interest free on US purchases at Amazon Business, AWS, Amazon.com, and Whole Foods

-Earn 2% cash back at US restaurants, US gas stations, and wireless phone service from US providers

-No annual fee

-No Foreign Transaction Fees

-10 Free Priority Pass Lounge visits per year

-Car Rental Loss and Damage Insurance

Cons:

-Earn 1% cash back for every $1 spent on everything else

-Low value intro bonus

-Benefits are pretty exclusive to Amazon

-Must keep the account open for 12 months or Amex can take back your intro bonus

-High APR and no late payment benefits (if that is important to your business)

DELTA SKYMILES RESERVE BUSINESS CARD

Yellow Light

-Good card for a Delta Loyalist

-Amex Platinum gets you similar, arguably better benefits

-Juicy companion certificate

Pros:

-Earn 45,000 bonus miles and 10,000 MQMs after spending $5,000 in purchases on your card within 3 months of opening

-Earn 3 miles for every $1 spent on Delta purchases

-Earn 1.5 miles for every $1 spent after you make $150,000 in purchase on your card each calendar year

-Earn 15,000 MQMs after spending $30,000 in purchases on your card, up to 4 times a year, and get the MQD (Medallion Qualification Dollar) waiver after spending $25,000 in purchases on your card

-First checked bag is complimentary on Delta flights

-Up to $100 statement credit for Global Entry or TSA Precheck every 4 years

-Complimentary access to Delta Sky Lounges when your flying delta and 2 complimentary guest pass each year

-Complimentary access to Centurion Lounges when you book your Delta flight with your Reserve Card

-No Foreign Transaction Fees

-Car Rental Loss and Damage Insurance, Trip Delay Insurance, Trip Cancellation, Baggage Insurance Plan, Purchase Protection, Extended Warranty

-Keep the miles if you cancel your card

-If you don’t have Medallion Status, your card adds you to the Complimentary Upgrade list, after Medallion Members

Cons:

-Annual fee of $550 not waived for the first year

-Earn 1 mile for every $1 spent on all other purchases

-Must keep the account open for 12 months or Amex can take back your intro bonus

-Miles exclusive to Delta products

-High APR and no late payment benefits on purchases outside of amazon brands (if that is important to your business)

LOWE’S BUSINESS REWARDS CARD

Yellow Light

-Instant $100 bonus for being approved

-No annual fee

-0% intro APR on purchases for 6 months

Pros:

-Get $100 cash back upon approval. Cash back is earned automatically as a statement credit

-Earn 3 points for every $1 spent at US restaurants, US office supply stores, and wireless telephone services directly from US providers

-Earn 2 points for every $1 spent at Lowe’s

-Get 5% off everyday at Lowe’s on eligible purchases

-Access benefits with Lowe’s ProServices, including Discounted Delivery, Bulk Rate Pricing, and the Business Replenishment Program

-No annual fee

-0% intro APR on purchase for 6 months

-Car Rental Loss and Damage Insurance

Cons:

-Points can only be redeemed for Lowe’s or American Express Gift Cards

-Earn 1 point for every $1 spent on all other purchases

-Must keep the account open for 12 months or Amex can take back your intro bonus

-2.7% Foreign Transaction Fee

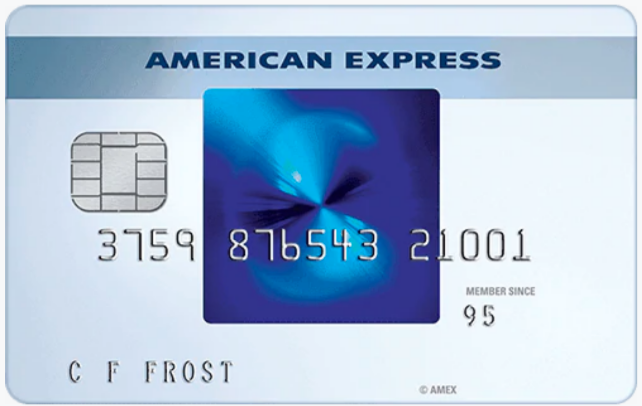

EVERYDAY PREFERRED CREDIT CARD

Red Light

-Good return on intro spend

-High annual fee for little in return

-0% intro APR on purchases for 12 months

Pros:

-Earn 15,000 membership rewards points after spending $1,000 in purchases on your card within 3 months

-Earn 3 points for every $1 spent at grocery stores up to $6,000 per year in purchases

-Earn 2 points for every $1 spent at US gas stations

-If you use your card 30 times on purchases in a billing period earn 50% more points on those purchases

-0% intro APR on new purchase and balance transfers for 12 months

-Car Rental Loss and Damage Insurance and Return Protection

Cons:

-$95 annual fee is not waived for the first year of membership

-Earn 1 point for every $1 spent on all other purchases

-Must keep the account open for 12 months or Amex can take back your intro bonus

-If you cancel your account membership points disappear

-2.7% Foreign Transaction Fee

BLUE FROM AMERICAN EXPRESS

Red Light

-No intro bonus

-Low point accrual

-Only if you’re trying to build credit

-Amex doesn’t have great cards for beginners

Pros:

-No annual fee

-Car Rental Loss and Damage Insurance

-Can help build credit

Cons:

-No intro bonus

-Earn 1% cash back for every $1 spent on purchases

-If you cancel your account cash back disappears

-2.7% Foreign Transaction Fee

-24% APR on purchases

DELTA SKYMILES BLUE CARD

Red Light

-OK return on intro spend

-No annual fee

-Waste of a hard inquiry

-Get the Delta Skymiles Gold instead

Pros:

-Earn 15,000 bonus miles after spending $1,000 in purchases on your card within 3 months of opening

-No annual fee

-No Foreign Transaction Fee

-Car Rental Loss and Damage Insurance, Purchase Protection, Extended Warranty

-Keep the intro bonus miles if you cancel your account

Cons:

-Earn 2 miles for every $1 spent at restaurants

-2 miles for every $1 spent on delta purchases

-Earn 1 mile for every $1 spent on everything else

-Miles are exclusive to Delta products

THE PLUM BUSINESS CARD

Red Light

-Low return on intro spend

-$250 annual fee waived for the first year

-Not worth the annual fee

Pros:

-Earn a $200 statement credit for each $10,000 you spend up to $30,000 in purchases on your card within the first 3 months of opening

-Earn 1.5% cash back if you pay off your purchases within 10 days

-Up to 60 days to pay off purchases with 0% interest

-Annual fee is waived for the first year of membership

-No Foreign Transaction Fee

-Car Rental Loss and Damage Insurance

Cons:

-Only get cash back if you pay off purchases within 10 days

-High spend to get back 2% for the intro bonus

-$250 annual fee for at best 1.5% cash back

-No anniversary bonus for the annual fee